4 Biggest Retirement Mistakes to Avoid in 2024

Retirement should be a time of relaxation and enjoyment, not financial stress or regret. Unfortunately, many retirees…

Golden Reserve

“Making investment decisions is simple!” said no one ever. But what if there was a way to see such decisions with unbiased clarity? Behold, The Overnight Test.

In a recent blog post, Carl Richards, the creator of The New York Times’ Sketch Guy column, asked readers to ponder: “What would you do if you purchased stock recommended by a family member years ago and it had only lost money since?”

Despite building a sensible financial plan within the last few years, including a portfolio of low-cost diversified investments, you continued to hold the loser stock. But one night, by some stroke of magic, someone sold the stock and replaced it with cash.

Now, for the Overnight Test. When you wake up, you get to choose: should you repurchase the stock or invest it in your portfolio? According to Carl, everyone he’s asked says they would invest it in their portfolio.

But Isn’t That an Easy Question?

Yes, because we didn’t have to face the loss in this scenario. And that’s the point. When it’s your real-life situation, emotion factors into your decision. Does selling the stock mean you’re admitting defeat? Will it be an acknowledgement that you’ve taken a loss?

The reason we don’t have the same clarity when the situation is our own is something called loss aversion. That’s a fancy way of saying people hate to lose and will do anything to avoid it. Loss aversion is so powerful it can cloud your judgement even when the facts demonstrate it’s time to let that stock go.

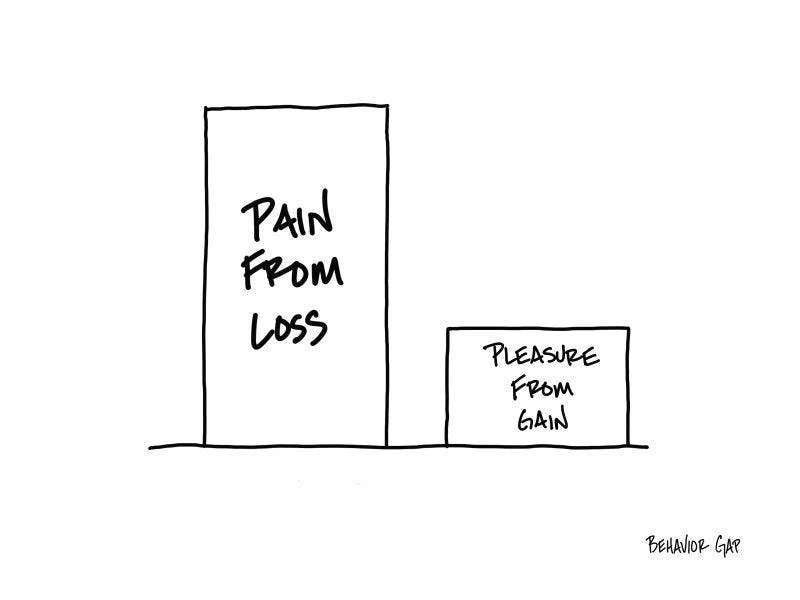

Carl masterfully sums that up in the following visual. Simply put, we feel the pain of loss more acutely than the pleasure of a gain. Yet the irony is we stand to gain more by accepting the loss. We see that in the decision to invest the cash in the portfolio.

Which brings us to our next point. If you’ve reached retirement, you’ve already won. Don’t let the financial services industry prey on your fear of missing out, holding the loss and adding to your risk while overstating the potential to win. As we’ve said before, retirement optimized investments aren’t always sexy, but neither is losing 30% of your portfolio. The Overnight Test makes that easier to see.

Share this article

Retirement should be a time of relaxation and enjoyment, not financial stress or regret. Unfortunately, many retirees…

Retirement is a significant milestone, a time to reap the rewards of years of hard work and…

All our working lives, we dream of what we’ll do with the money we’ve saved and the…

Recently, a publication targeted toward financial advisors published an article wondering if advisor fees based on assets…